Undertaking economic evaluations of projects and business costs is a crucial function performed by companies on behalf of their shareholders to ensure that capital is invested prudently.

This book describes the underlying concepts, measurements and methodologies employed by companies to perform economic evaluations of projects, leases, tariffs and acquisitions.

This book is written for project economists, corporate managers, business students, contract lawyers and anyone interested in learning about economic evaluations.

Ted Lawrence worked in the Canadian oil and gas industry for 40 years until retiring. He supervised a multitude of economic evaluations primarily for Canadian ventures, but also for USA, North Sea, North Africa and Middle East ventures. Ted instructed numerous in-house economic evaluation workshops over the years and was repeatedly asked to recommend a good economic evaluations book. Having not come across such a book, writing this book became his retirement project. Ted received his Bachelor of Mathematics from the University of Waterloo and his Masters of Business Administration from the University of Calgary.

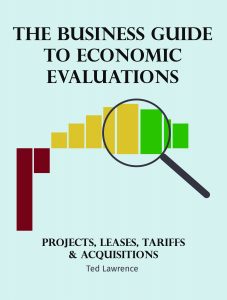

This bar chart and magnifying glass appearing on the book’s front cover displayed above symbolize the essence of performing an economic evaluation of a project. The bars represent the annual cash flows generated by a project. The red bars represent the years in which capital is provided to a project. The yellow bars represent the years in which capital and its funding cost are recovered from a project’s cash flows. The green bars represent the years containing the remaining surplus cash flows which are termed economic profit. Economic profit is desired because economic profit drives the measures of economic profitability. Economic profitability is achieved when a project’s cash flows transition from the yellow bars to the green bars within a reasonable time period as highlighted by the magnifying glass and as determined by an economic evaluation. A full explanation of this bar chart, its supporting project cash flows, the meaning of capital and its funding cost, and the measures of economic profitability are provided in the first 16 chapters.